What are transfers?

Gone are the days when you'd choose a provider and stick with them through thick and thin, just to avoid the pain and price of moving somewhere else.

Your savings and investments are your future, so it's vital you keep them somewhere that works best for you.

Transferring your accounts - be it an ISA, Lifetime ISA, pension or general investment account - is now easier than ever and can give you greater control over your financial future.

What can you transfer to Dodl?

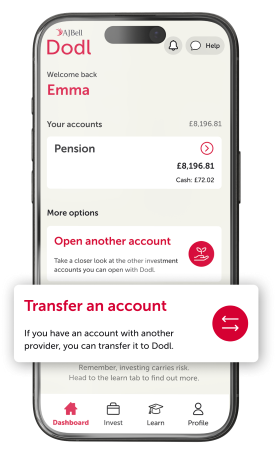

Most ISAs, Lifetime ISAs, pensions and general investment accounts can be transferred to Dodl. Click on the account you want to transfer to find out some important points about moving it to Dodl.

If you’re not sure about transferring your pension (or any other account) to Dodl, make sure you speak to a suitable financial adviser about this before making your decision.

Why transfer to Dodl?

You can transfer an account to Dodl quickly and easily - but why should you transfer?

What happens next?

Then you'll hand the reins over to the safe and experienced hands of the transfer team at Dodl, who'll finish up what you started, chatting to your existing provider to arrange for everything to be moved over to your Dodl account.

The time it takes to transfer an account varies, but here's Dodl's rough guide to transfer timings.

| Type of transfer | Time taken |

|---|---|

| Cash only | 2-4 weeks (up to 6 if your existing provider needs a paper form) |

| Cash and investments | 6-8 weeks |

Feeling ready to make the switch? Download the app to get your transfer started.