What is an investment ISA?

Also known as a stocks and shares ISA, it’s your simple, tax-free investment account.

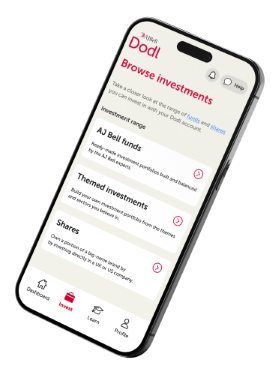

For the full details of the Dodl investment ISA, make sure you read its key features.

Get your money working straight away

We don’t want you to rush when deciding where to invest your money. That’s why we’ll pay you 3.80% AER variable interest on any cash in your account that’s not yet invested.

So, while you learn more about investing with our excellent tools and tips, your money will already be working for you.

Investment ISA charges

For 12 months, the Dodl investment ISA comes with ZERO account charge – meaning more money in your pocket.

How to get started

It’s as easy as 1-2-3 to get started with a Dodl investment ISA.