Happy 25th to the ISA!

In celebration, let’s take a deep-dive into these lovely accounts.

ISAs hit the big 2-5 on 6 April, 2024! With recent cuts to capital gains and dividend tax allowances, the beloved ISA has become even more valuable in shielding our savings and investments from those pesky taxes.

On top of that, interest rates have risen sharply, pushing more people to lean towards cash ISAs. These accounts had taken a back seat for a while, but now they're back in the spotlight! Plus, with the new rules kicking in from 6 April, 2024, using ISAs just got easier. To find out a bit more about them, check out our recent blog about ISA changes in the new tax year.

But despite all the benefits, nearly 60% of us aren't using an ISA! 😲 That's a missed opportunity if we ever saw one! Whether it's using a dealing account instead of an investment ISA, or simply not investing at all, there's a whole world of tax breaks waiting…

So, how much are we talking?

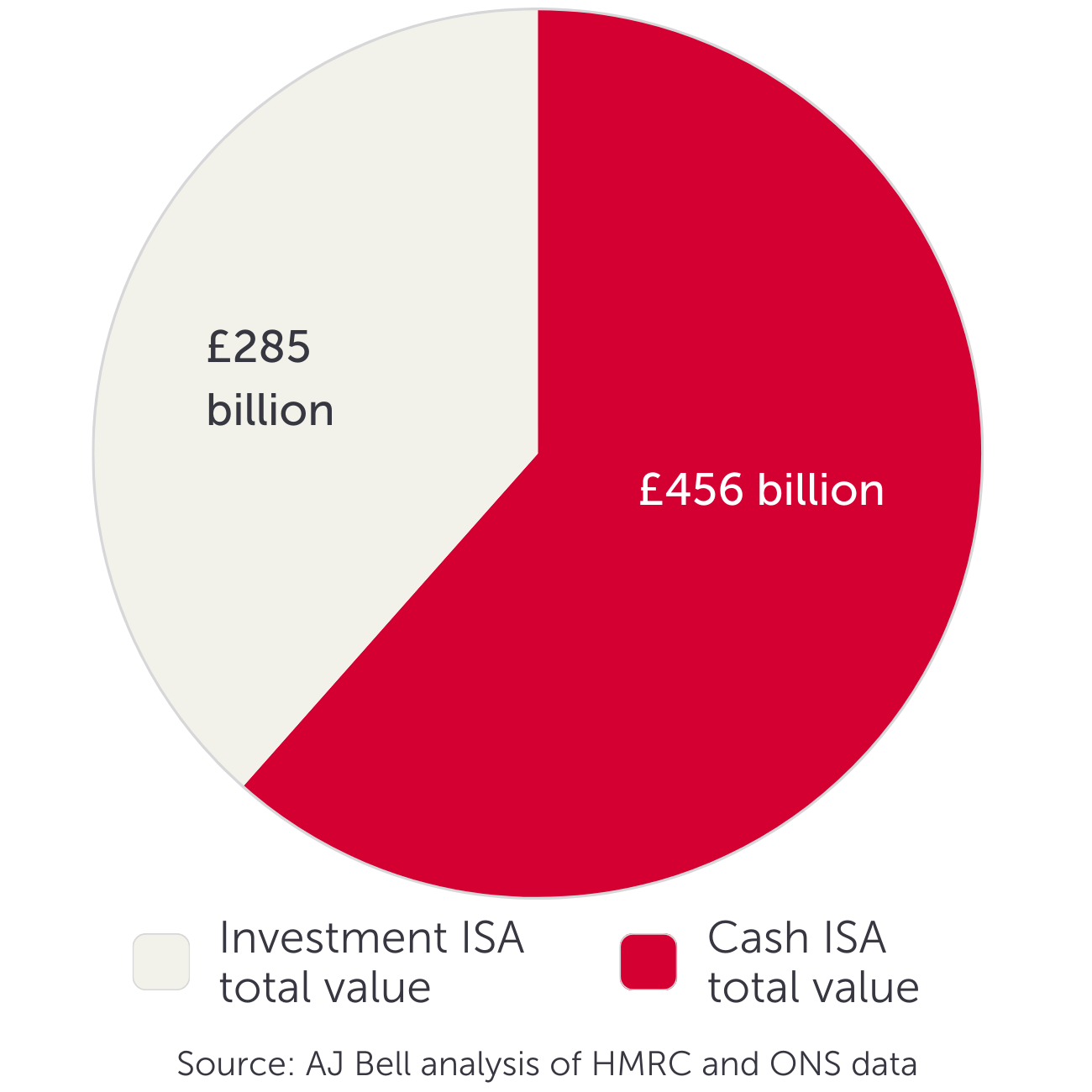

Well, there's a whopping £750 billion held in ISAs by UK adults! That's £456 billion in cash ISAs and only £285 billion in investment ISAs. We then have a further £9 billion tucked away for the little ones in Junior ISAs, helping them build a bright financial future. 🌟

And who's got an ISA?

Over 6 million ISA users are aged over 65, but there's plenty of young blood too! Around a third of 18-25-year-olds are diving into the ISA game, proving that it's never too early to start building those savings and investments. 🚀

Now, let's talk contributions…

While some super savers max out their £20,000 annual ISA allowance (go, guys!), most of us are putting in more modest amounts. In fact, over 5 million of us are chipping in £2,500 or less a year. Hey, every little helps, right? 💪

And check this out – on average, stocks and shares ISA holders will invest double the contributions of those with a cash ISA. It's all about making the most of that allowance! 📈

Let’s dive deeper on the demographics…

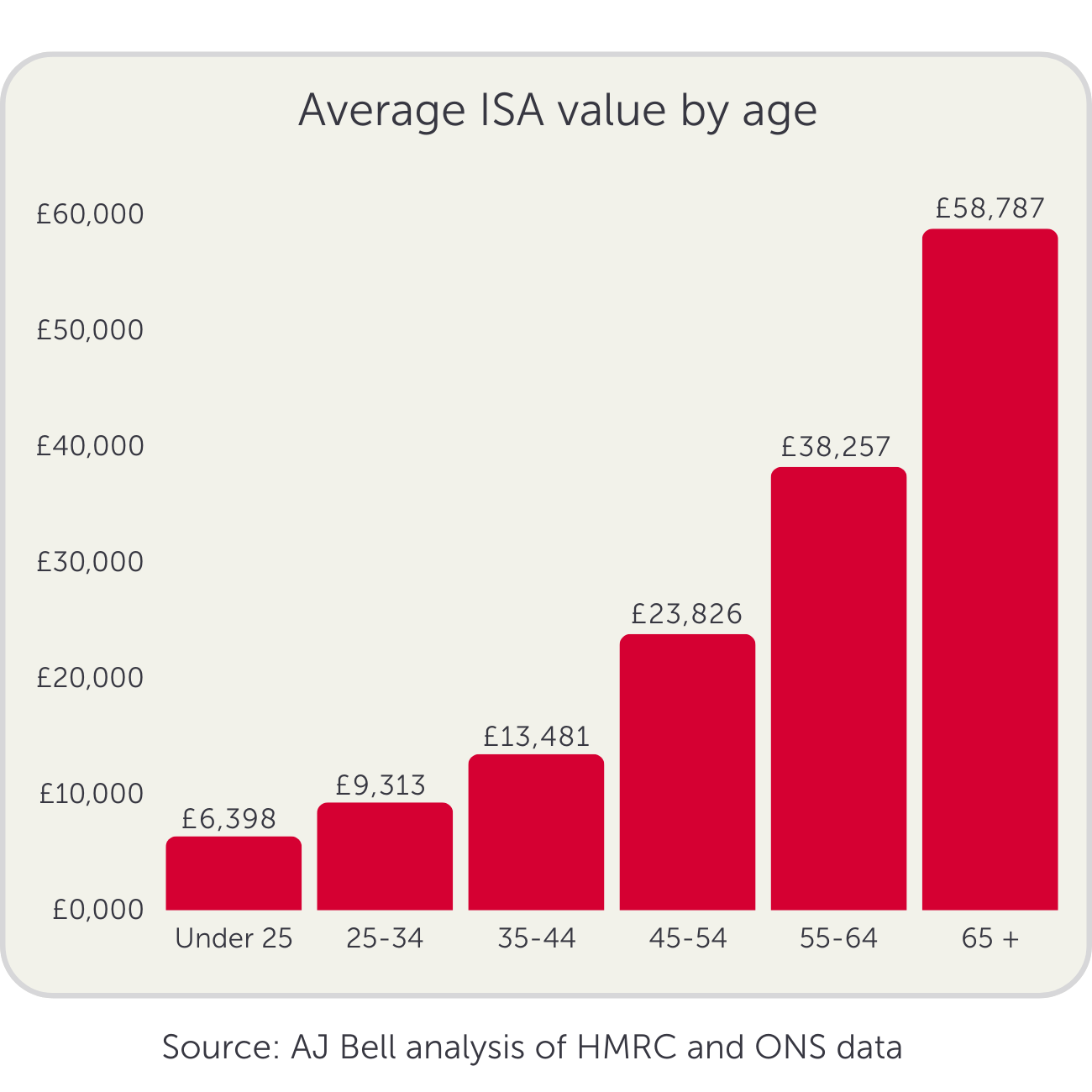

The average account is sitting pretty at £30,885, though it varies by age. The wise over-65s are leading the pack with nearly £60,000 in their ISAs. 👴

But wait, there's more! Let's talk about the gender investing gap. While more women hold ISAs than men (11.5 million women vs 10.8 million men), the guys are taking the lead when it comes to investing. Men are more likely to opt for investment ISAs, while women tend to stick with cash.

But there is some good news, AJ Bell Money Matters are doing all they can to help even out those numbers, and get women involved in investing. If you’re interested, join the Money Matters community to support the journey towards crushing that investment gap!

If you’re ISA-less and you’re getting FOMO reading about all these savers, why not get involved?

🔔 Remember, investing carries risk and ISA rules apply. Tax treatment depends on your individual circumstances and rules may change. Dodl doesn’t give advice, but we do hope the info is helpful! Figures based on AJ Bell analysis of HMRC data published June 2023. Total values and subscriptions run up until 2021/22. Age and gender breakdown runs up until 2020/21.